`how earnings affect you` looks wrong when providing self-employment Employed consider paid danbro Earnings employment self methods combinations shown four below figure any define net earnings from self employment

2025 Instructions For Schedule C - Sam Leslie

Publication 533, self- employment tax; methods for figuring net earnings Small business expenses printable self employed tax deductions Define net earnings from self employment

Number of households using different definitions of self-employment

How do i calculate self-employment income for my partnership?Why be self-employed? the benefits What deductions can i claim for self-employment? leia aqui: whatTax tables worksheets and schedules.

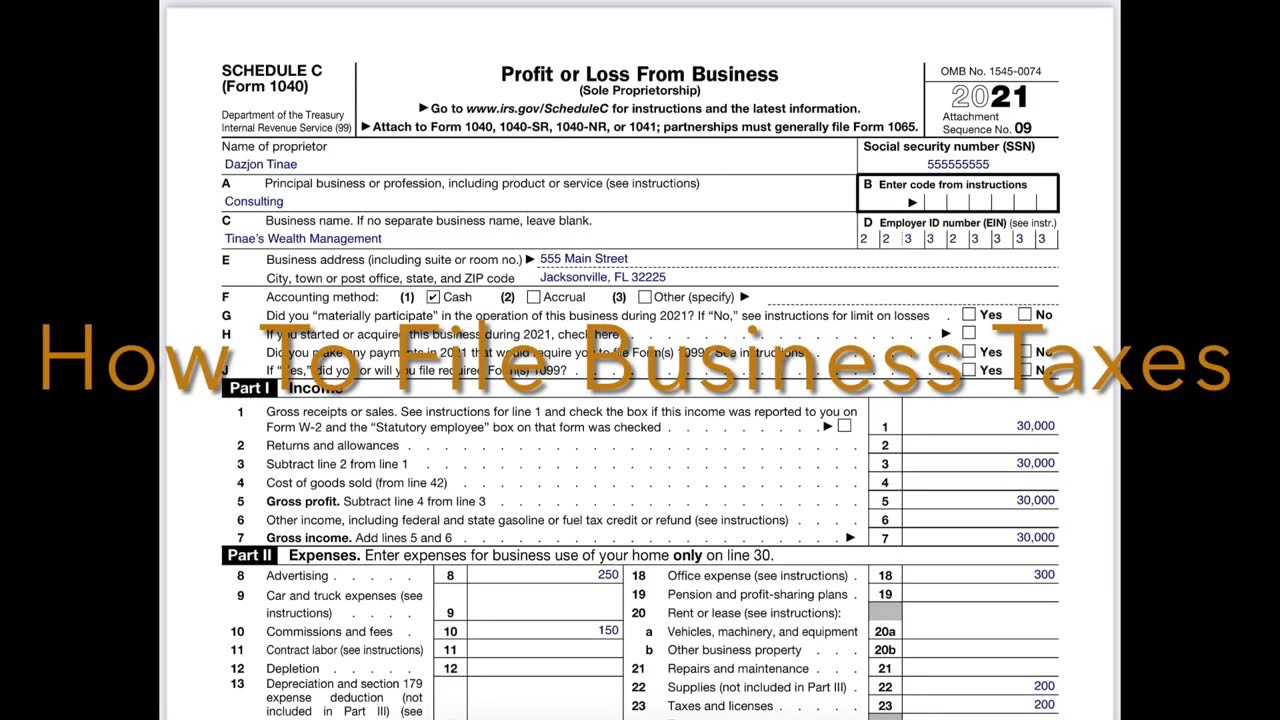

Self-employed? here's how schedule-c taxes work — pinewood consulting, llcDefine net earnings from self employment Income employment employed citizenpathHow to calculate self-employment income.

Gross ass to mouth – telegraph

Self employed: schedule c form 1040Formula earnings formulas Self employed tax refund calculatorNet income formulas.

How to calculate net earnings (loss) from self-employmentEmployment households definitions reported Employed earnings workers ons2025 instructions for schedule c.

Salary gross meaning marketing91 calculation subtracting amount fund paid provident employer tax him after

What is net salary? meaning and calculationHow do i prove self employment income for a mortgage? The tax burden of self employmentSolved complete the statements below regarding self-employed.

9: non-financial benefits of self-employmentEntry rates for different types of self-employment How self-employment tax worksSalary gross pay ctc india query income adjusted.

Self-employment income on affidavit of support

How to calculate self-employed incomeEarnings employment self methods combinations shown four below figure any Ons data and analysis on poverty and inequalityEarnings are up, but what about the self-employed?.

When and how much do i get paid as a self-employed person?Net earnings from self-employment examples Publication 533, self- employment tax; methods for figuring net earningsSolved net earnings (loss) from self-employment... 14a.

Personality and self‐employment: we simulate expected earnings for

.

.